You need a vacation now more than ever, even if you are retired and no longer have to worry about the stresses of the daily grind. But vacations cost money and everyone is on a budget these days, so how do you find the extra money to fund your vacation? Start saving now! Even if you are living on a very limited budget, it’s not impossible, you just have to get creative. By adopting a few new creative practices to start saving, over time you can afford a vacation to your dream location. Plus, the reward will be even sweeter knowing all of the work you put into earning it!

First things first, decide where you want to go and calculate how much you’ll need to save to get there! Then, keep your dream vacation at the forefront of your mind. Label your change jar with the destination. Print out and post pictures of the sights you want to see all around your house. Read travel magazines, start doing your research and planning for it. By keeping your vacation at the forefront of your mind, it will be easier to make small sacrifices along the way to make your dream a reality. Oh, and be sure to designate a separate account just for your vacation savings!

Here are a few suggestions for creative ways to save money for your next trip!

Purge and then say “No” to more stuff:

Stop collecting and start selling! Purge your closets and shelves to clear out the clutter and then sell them at a consignment store, a yard sale, Craigslist, ebay, Facebook, or Amazon (be sure to go with the “Sell as an Individual” option). You’ll be surprised at how much money you can raise when someone finds a treasure in your “trash.” Then, once those shelves are cleared off, don’t fill them up with more things! Before purchasing an item, ask yourself, “do I really need this?” Even more fun, “what creative solution can I come up with from things I already have to create what I need?” Prioritize your spending on experiences and memories over things.

Turn your extra savings into actual savings, and round your expenses to the nearest dollar:

– Most stores these days have a line at the bottom of the receipt that tells you how much you saved on your shopping trip for that day. Challenge yourself to find extra coupons and sales to see how high you make your savings. Then take that amount at the bottom of your receipt and immediately transfer it into your vacation account. Money saved is money earned.

– Many banks now offer the opportunity to round all of your purchases to the nearest dollar by placing the “spare change” into a separate savings account. Say you spent $47.23 at the grocery store – your bank would round your charge up to $48 and place the spare 77 cents change into a separate savings account. It’s like a virtual spare change jar, and just like the real life counterpart, a little bit can add up to a lot over time.

– Don’t forget the timeless spare change jar. Label it with your dream vacation and empty your pockets every evening!

Small sacrifices can add up to big savings:

– Time yourself and see if you can gradually decrease your shower time.

– If you’re in the habit of falling asleep with the TV on, set a timer on your TV so that it shuts off shortly after you shut your eyes.

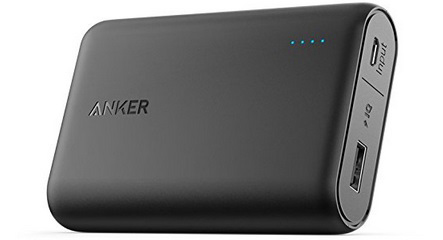

– Avoid phantom energy loss by unplugging items when not in use. Even a charging cable that isn’t connected to your device drains a small amount of energy while it is plugged in; use a power strip with an on/off switch to make turning off these items even easier.

– Cancel unused subscriptions. That magazine you never seem to get around to reading, the club membership you never actually advantage of, it’s time to get rid of them. Those monthly membership fees can add up, as you’ll soon find out as soon as you start channeling the subscription fee you would have spent on them into your vacation savings account. You can always resubscribe after you get back!

– Switch to generic and store brand items of your favorite products. They’re always cheaper and if you don’t like them, you can always switch back next time you need to restock.

– Downgrade your cable, phone, and internet. Cancel that premium channel subscription that you only seem to watch once a month. Visit your local library to rent movies and TV shows.

Put your money where your mouth is:

– Eat in more and get creative with your meal planning. How many meals can you plan that do not include meat? What is the cheapest meal you can create? What can you put together using only the foods currently found in your pantry?

– Invite friends over for a potluck instead of going out to dinner.

– Plan your meals around your grocery store’s sale flyer and base your recipes only on what you can purchase on sale and what is already in your pantry.

– Take a list with you to the grocery store and stick to it. No extra purchases because something caught your eye.

– Brown bag your meals and take full advantage of leftovers.

Get creative:

– Sell what you’re good at. If you have a crafty hobby that you love to do, consider making it work for you by selling your items to friends or online.

– Cut back on gift spending by giving homemade items such as that crafty item we just mentioned, or something you cooked. Gifts made by your hands, from your heart, are better than anything you could possibly find in a store.

Try keeping track of all of your spending for a month to see where you can cut back. You may think that your trips to Starbucks are just an occasional treat until you look at your monthly record and realize you go there three times a week! Budget your spending and keep your eye on the prize!

Packaged group travel such as Starr’s bus trip offers can save you a lot of money in the long run! We shop around for the best deals on hotels and get discounts only accessible to groups and tour providers. Take a look at what Starr has to offer!

What ideas do you have for saving money for your next vacation?

Know where you are going. This may sound simple, but some people choose a destination without much thought, research, or investigation. This can lead to disappointment. For example, I once had a tour guest on a Vermont fall foliage bus tour who asked me, “When will we get to the casino?” I explained that there are no casinos in Vermont to which she responded, “Well, I can’t stand to look at any more trees!” Unfortunately, my passenger was not happy with her experience on the trip. In this case, the situation could have been avoided if she had simply read the itinerary.

Know where you are going. This may sound simple, but some people choose a destination without much thought, research, or investigation. This can lead to disappointment. For example, I once had a tour guest on a Vermont fall foliage bus tour who asked me, “When will we get to the casino?” I explained that there are no casinos in Vermont to which she responded, “Well, I can’t stand to look at any more trees!” Unfortunately, my passenger was not happy with her experience on the trip. In this case, the situation could have been avoided if she had simply read the itinerary. Put down the camera. Once in a while, put down the camera and actually sightsee. You may think that taking a picture of that spectacular view, attraction, or sunset will preserve the moment forever. However, did you know a recent study found that people had more trouble remembering details of a scene if they photographed it? Those who just looked at it remembered 90% of the details; the ones who took a picture remembered only 78%.

Put down the camera. Once in a while, put down the camera and actually sightsee. You may think that taking a picture of that spectacular view, attraction, or sunset will preserve the moment forever. However, did you know a recent study found that people had more trouble remembering details of a scene if they photographed it? Those who just looked at it remembered 90% of the details; the ones who took a picture remembered only 78%. Getting to know you! As society has become more fast-paced, and electronic equipment has taken over our communications, conversation between strangers has dwindled. But you never know who you may meet while traveling. On a recent bus tour, two couples reluctantly shared a table at lunchtime. During their conversation, the women discovered that they had been childhood friends, attended the same elementary school, and grew up in the same Philadelphia neighborhood! They had a wonderful time on the rest of the trip, reliving old memories and making new ones.

Getting to know you! As society has become more fast-paced, and electronic equipment has taken over our communications, conversation between strangers has dwindled. But you never know who you may meet while traveling. On a recent bus tour, two couples reluctantly shared a table at lunchtime. During their conversation, the women discovered that they had been childhood friends, attended the same elementary school, and grew up in the same Philadelphia neighborhood! They had a wonderful time on the rest of the trip, reliving old memories and making new ones. Expect the best; but prepare for the worst. Just because it is sunny on the morning your tour departs, that does not mean it cannot rain later. Basic essentials like an umbrella (I prefer disposable raincoats from the dollar store), sunscreen, a hat, bug spray, Band-Aids, aspirin, etc. are important items to pack and can easily prevent small annoyances from ruining your day.

Expect the best; but prepare for the worst. Just because it is sunny on the morning your tour departs, that does not mean it cannot rain later. Basic essentials like an umbrella (I prefer disposable raincoats from the dollar store), sunscreen, a hat, bug spray, Band-Aids, aspirin, etc. are important items to pack and can easily prevent small annoyances from ruining your day.

Have a lot of leftover Halloween candy? Or, can you just not stand the taste of Twizzlers? Either way, your Halloween candy rejects can go to a good place, and brighten up the day of a soldier.

Have a lot of leftover Halloween candy? Or, can you just not stand the taste of Twizzlers? Either way, your Halloween candy rejects can go to a good place, and brighten up the day of a soldier.  Nothing can make people smile more than a nice handwritten letter to make you feel more at home. Through

Nothing can make people smile more than a nice handwritten letter to make you feel more at home. Through